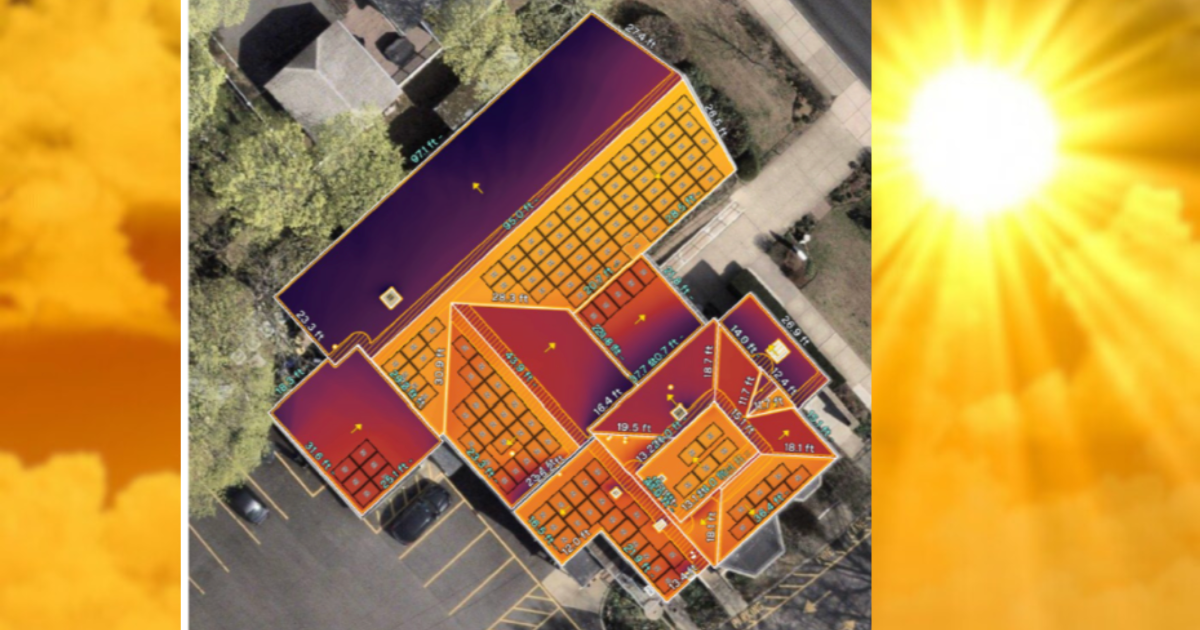

Solar and Sustainability Campaign

Donate here for HBT’s Renewable Energy Future

Learn more about giving options

💳 Donate Online

Use your credit card or Apple Pay for a secure contribution to the Solar & Sustainability Campaign.

You may also dedicate your gift in honor or in memory of someone, or request an acknowledgment.

💙 Prefer to Pledge by Check, RMD or Zelle?

Use the pledge form to share your pledge amount, dedication, or RMD.

You’ll receive a confirmation once submitted.

💬 Have questions or need help with your Solar Campaign donation?

We’re here to support you with pledges, dedications, adopting a solar panel, or choosing the best payment option. You can email Benita and Laurie or call the Temple office.

The email button opens a pre-filled message that includes space for your name and phone number.

Check Payments: Make checks payable to Temple Hillel B’nai Torah

Please include “Solar Campaign” in the memo line.

Zelle Payments: Send to donations@templehbt.org via your bank’s app.

Include your name and the purpose, such as “Solar Campaign”.

RMD Distributions: Please instruct your financial provider to include your name

and the solar designation on all documentation.

Exploring Thoughtful Ways to Give

If you are considering a contribution to HBT’s Solar and Sustainability Campaign, there may be meaningful and tax-efficient ways to structure your gift. We offer this information as a service to our members and friends—especially those thinking about long-term impact, required distributions, or estate planning.

- IRA Qualified Charitable Distributions (QCDs): If you’re 70½ or older, you may give directly from your IRA without paying income tax. If you're 73+, this can also satisfy your Required Minimum Distribution (RMD).

- Gifts of Appreciated Stock: Donating stocks or mutual funds you’ve held for over a year may help you avoid capital gains tax and claim a charitable deduction.

- Donor-Advised Funds: You can recommend a grant to HBT from your existing DAF.

- Charitable Gift Annuities: Make a gift that provides income to you for life—while supporting HBT in the future.

- Bequests and Legacy Gifts: Naming HBT in your will or estate plan ensures your values live on in our community.

We encourage you to speak with your financial or legal advisor. If you have any questions, please feel free to contact the HBT office.